While the Louisiana Purchase in 1803 drastically enlarged the land area of the fledgling United States—about 827,000 square miles was acquired in the deal with France—the Mississippi River, which formed much of the eastern boundary of the purchase, and more specifically the mouth of the river, proved to be the commercial and strategic linchpin for the agreement.

“We were able to get goods and services from the interior of the United States to all over the world, and it was done by that river system,” said Sandy Sanders, executive director of the Plaquemines Port, Harbor & Terminal District, which spans the final portion of the Mississippi before it reaches the Gulf of Mexico.

Just as access to and control of the Mississippi River proved transformative for the country in 1803, it remains so today. And with the movement of cargoes in the United States, specifically containerized cargoes‚ expected to grow exponentially over the next decade and beyond, Sanders said he believes the Mississippi River and its tributaries will again propel the country into the future, this time thanks to a system of container ports and a fleet of inland container vessels that could be operational in just over two years.

Speaking October 1 as part of the virtual Inland Marine Expo (IMX) hosted by The Waterways Journal, Sanders and two colleagues, Louisiana 23 Development Company CEO Chris Fetters and American Patriot Container Transport (APCT) CEO Sal Litrico, offered an update on a planned container terminal in lower Plaquemines Parish, a network of container-handling terminals upriver, and a to-be-built fleet of inland container vessels.

Litrico explained that, with oceangoing container ships growing to capacities in excess of 20,000 TEUs (20-foot equivalent units) and with congestion at ports on the east and west coasts, the market is ripe for a new trade lane for containerized cargoes.

“There’s a compelling need for a new north-south trade lane and infrastructure that supports it,” he said.

To meet that need, Litrico and his colleagues at American Patriot Holdings (of which APCT is an affiliate) are planning to build a fleet of innovative inland river container vessels to transport containerized cargoes throughout the nation’s heartland. APCT has two vessel designs. The larger “liner” vessel would measure 595 feet by 134 feet, have a capacity of 2,375 TEUs and would travel between a container terminal in lower Plaquemines Parish and ports in Memphis, Tenn., and St. Louis. A smaller, “hybrid” vessel would have a container capacity of 1,700 TEUs and be a little narrower, 100 feet, to allow it to move through locks and low-lying bridges on the Upper Mississippi River and tributaries.

With a patented exoskeleton hull designed to generate little to no wake, the liner and hybrid vessels would have an upriver speed of 13 mph. The vessels will be LNG-powered and will be able to carry a diversity of cargo, including refrigerated containers, down-bound agricultural products, imported raw materials and manufactured goods and more.

But the inland container vessels are only one part in the group’s three-part plan. Sanders and Fetters focused on the container terminal planned for Mile 50 on the Lower Mississippi River on the east bank of Plaquemines Parish.

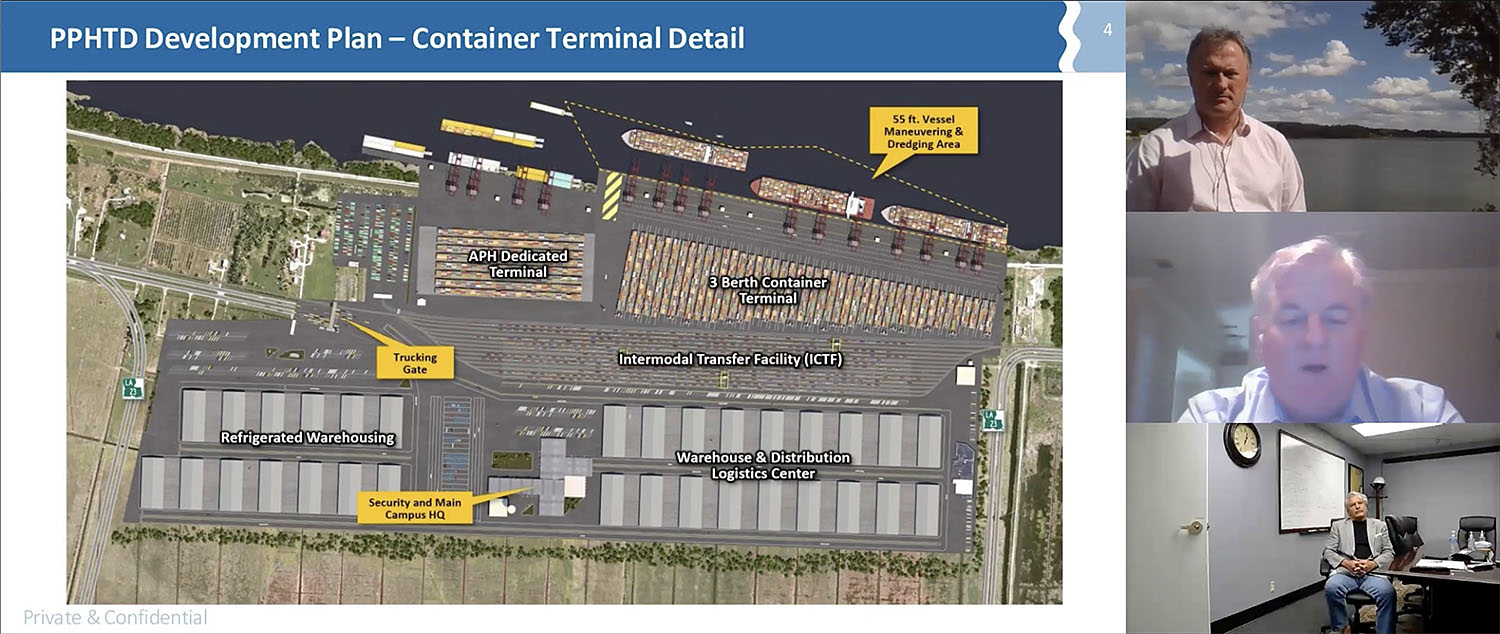

“The scale of this is quite immense,” said Fetters, whose company is handling the terminal business development effort for Plaquemines Port. “It’s a 1,000-acre facility capable of having five total maritime berths, three for the newest generation of oceangoing vessels [20,000 TEUs and above].” Directly upriver to that are two additional berths for the revolutionary APH inland container vessels.”

Fetters said Phase 1 of the buildout will include two berths for oceangoing container vessels, which will bring a 500,000-TEU-per-year capacity at the terminal to start.

“As the market responds, we have the ability to build out and complete it to that five-berth system, with probably an upper limit of about 2.5 million TEUs,” Fetters said. “What we’re seeing from the financial world is a really positive response.”

On site, the terminal will also offer space for refrigerated warehousing, a warehouse and distribution logistics center, parking and office space. Also, thanks to Plaquemines Parish’s connectivity to LNG pipelines and planned export terminals, the container terminal will have the ability to generate off-the-grid power from natural gas.

The preliminary design for the terminal includes rail capacity for six unit trains, Fetters said, with connection to both Union Pacific and BNSF railways in Avondale, La.

“To supplement that as well, we have a four-lane, divided highway access for our drayage, as well as a nearby air base where we can introduce commercial cargo,” Fetters said. “When you combine that with pipeline access, this is a fully multimodal terminal that can be brought online as a gateway facility.”

Once containers are offloaded from oceangoing ships and stacked onto an APCT vessel, they will head upriver to partner ports farther north on the Mississippi River and its tributaries, comprising the third component of the system. Memphis and St. Louis will be the larger upriver ports in the system, with other ports along the waterways planning to add machinery and infrastructure needed to berth the APCT vessels and handle containers.

“We’re really creating a new transportation system that connects the Midwest to the Lower Mississippi River to worldwide destinations,” Litrico said. “It’s taken several years to align all these critical drivers and roles, but we’re at the place now where we’re getting ready to cross the finish line.”

Plaquemines Port, Louisiana 23 Development Company and American Patriot Holdings are in the midst of a six-month due diligence period for all parties, including potential investors, to study the feasibility of the project. Sanders, Fetters and Litrico were all bullish on the outcome of that study.

“We anticipate to complete this due diligence process, which will take us to what we call ‘FID’ or ‘final investment decision,’ … by the first quarter of 2021,” Litrico said. “We’ll achieve operational startup the first quarter of 2023 for Phase 1, which is one vessel and one weekly service at selected ports, including Plaquemines.”

The panelists fielded questions from attendees of the virtual IMX session. With numerous hurricanes impacting the Gulf Coast in 2020, and with the planned Plaquemines container port to be located on a narrow strip of land that extends into the Gulf, one question touched on the resilience of the terminal.

In response to that, Sanders pointed to the development model for the project.

“I think it’s very important to note that our port is being built by a true public-private partnership,” Sanders said. “Our building, our terminal, all the infrastructure that supports that is based on a business plan that private money has looked at, kicked the tires, looked under the hood, and they’ve said, ‘This risk is worth us taking.’”

Fetters added that the terminal will be elevated to limit flooding, with the entire facility designed for a quick recovery regardless of the storm.

“Our idea is what we call wet mitigation,” Fetters said. “As soon as the surge disbands, we have the ability to go in, clean the deck and get started again.”

A second question focused on the diversity of cargoes possible with container transport, in particular how the agriculture industry could take advantage of regular container ship calls at ports in the Midwest. Litrico pointed to a study from October 2018 that examined containerized exports by way of the inland waterways compared to road, rail and traditional barge transport.

“What it really surmises is there’s tremendous added value, lower costs, and the fact of the matter is, if you look at the growth model of containerized cargo over the next 10 years, there’s significant growth projected due to chain of custody, non-GMO, smaller lots, Asia, Vietnam and some of those other South Pacific countries,” Litrico said. “I think agriculture will play a big role for export cargo.”

Litrico said, as with container transport overall, the inland liner service will need both inbound and outbound containers. Fortunately, Litrico said, the prospective cargoes and interested parties will likely make that a reality.

“The good news is, with the type of business we’re attracting and the potential to utilize our system, it starts rationalizing the import with the export,” Litrico said, later adding, “There has to be balance between both, and we’re putting as much effort into the import as we are the export.”

Caption for photo: A screenshot from the Inland Marine Expo panel on the Louisiana Gateway Terminal shows the layout of the proposed terminal and panelists Ken Eriksen (moderator), Sal Litrico and Sandy Sanders.