The Mississippi River System is characterized as the backbone of the economy of the United States, connecting 18 states and the global marketplace. The combined population of those states totals nearly 103 million, or three out of 10 people in the United States. Importantly, those states are resource-rich and industrially advanced. The resources of those states include the core ingredients that feed, fuel and are used as inputs to the manufacturing sector in the United States and around the world.

Think of the Mississippi River system as a giant funnel that reaches Omaha, Neb.; Minneapolis, Minn.; Chicago, Ill.; Pittsburgh, Pa.; Chattanooga, Tenn.; or Tulsa, Okla. From those locations, commodities such as corn, soybeans, prepared animal feed products and coal are harvested, produced and mined and gathered onto a barge at one of the several hundred terminals and docks that dot the map of the system. Those barges are then towed downriver to export positions or other states for consumption within the United States. Meanwhile, the same waterway system reaches Brownsville and Houston, Texas, and Mobile, Ala., along the Gulf Intracoastal Waterway, where energy and petroleum-based commodities and products are loaded onto barges and towed upriver for domestic consumption.

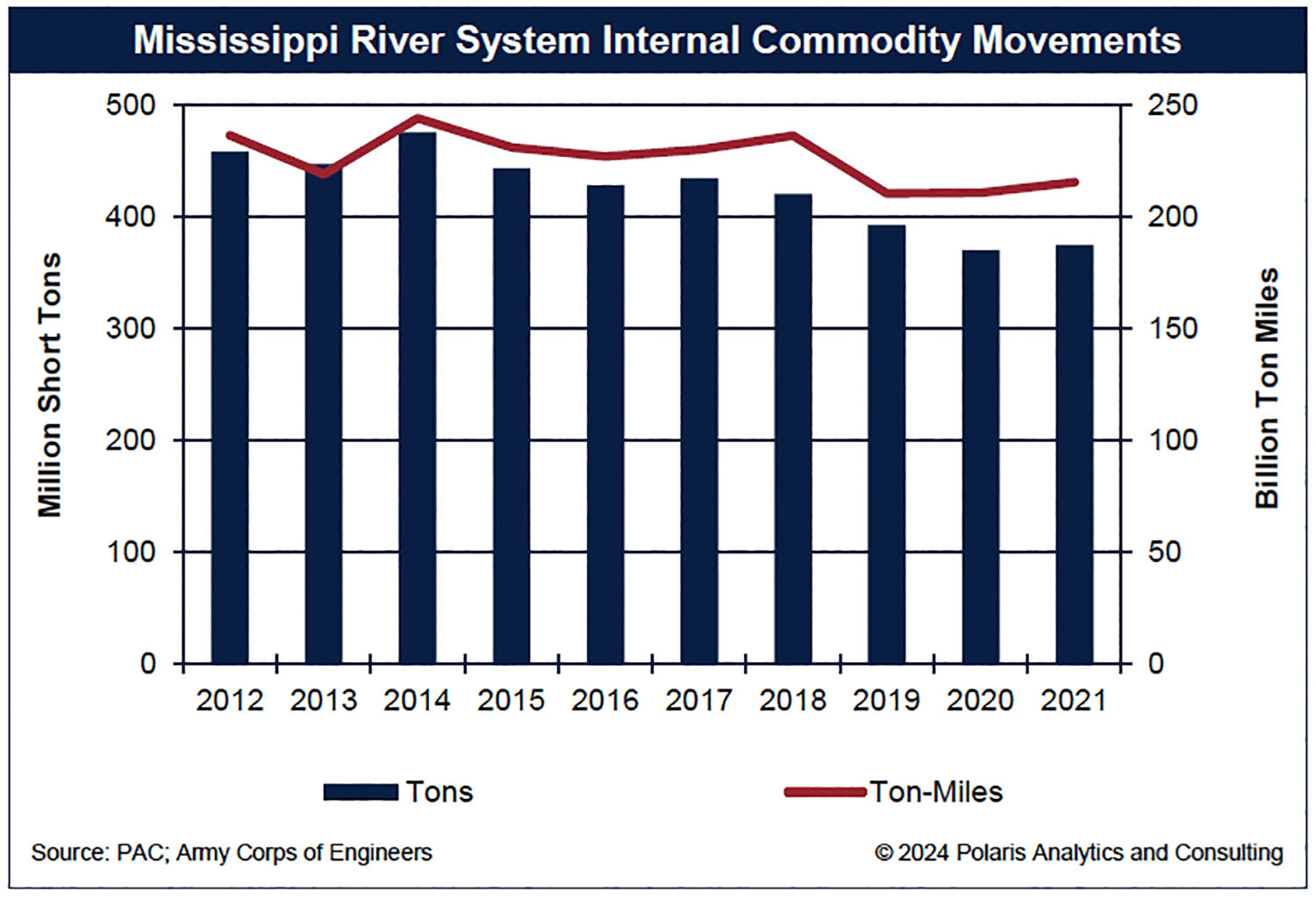

The volume of commodities and products moved on the Mississippi River system over the last decade since 2012 has declined, ranging from a high of 475 million short tons in 2014 to a low of 370 million in 2020. Cargo ton-miles—that is, moving one ton of cargo one mile—ranged from 244 billion ton-miles in 2014 to 210 billion in 2019. The average distance that all commodities moved (ton-miles divided by tons) on the system averaged 534 miles over that same decade, from a low of 490 in 2013 to a high of 575 in 2021. The most current data available for the internal Mississippi River system from the Waterborne Commerce of the United States of the Army Corps of Engineers is through the calendar year 2021.

Despite the range of cargo that has moved by barge on the Mississippi River System, the trend has been in one direction, down by 83 million tons between 2012 and 2021. The cargo drop is essentially led by one commodity: coal. The volume of coal collapsed by 101.7 million tons over the past decade, led by policies that have de-emphasized the use of coal for domestic energy requirements and emphasized competitive and alternative fuels. Remember, when there is a disruption such as a policy shift or change, it has downstream impacts, and this is highly noticeable with coal shipments by barge. However, coal has found a firm footing with stronger exports to supply power needs in Europe, North Africa and India. While the exports are significant volumes, they are not enough to offset the loss of coal used for U.S. domestic energy needs.

Other commodities have experienced growth, including agricultural crops. Corn movements, for example, more than doubled from 18.5 million in 2013, which was historically low following the drought-reduced crop of 2012, to 40.9 million in 2021. Volumes of soybeans were up 1.8 million tons from 2012 to 28 million tons in 2021. However, soybeans were greatly impacted by China placing a hefty tariff on U.S. commodities and products in 2018 through 2019, which led to a large drop in soybean exports. Movements of soybeans by barge peaked at 36.5 million tons in 2016. Sand and gravel cargoes used for construction and infrastructure efforts increased steadily over the past decade from 25.2 million tons in 2012 to 35.5 million in 2021.

Energy commodities and products such as crude petroleum and residual fuel oil moved by barge have declined over the decade. Gasoline movements by barge are steady at more than 10 million tons annually while asphalt, tar and pitch volumes have increased about 2.7 million tons over the past 10 years through 2021 to 7.3 million.

There are many other interesting cargoes to dig in and understand more fully, but the unfortunate thing is that data from the Corps is quite dated, and there have been changes to policy, infrastructure and the economic re-emergence from the pandemic. Agricultural commodity volumes have fallen since the Corps update through 2021.

Looking to the horizon, U.S. commodity exports face certain headwinds. China’s population is contracting where the grand population control experiment failed. Crop competition in Brazil has expanded significantly with more ground to gain. Despite Russia’s war with Ukraine, Russia continues to send large volumes of wheat to the global market. Australia had three consecutive record wheat crops, with this year’s crop better than expected even with the presence of El Niño. The world is awash in feed grains and oilseeds, making for a competitive environment for buyers. Unless there are simultaneous crop problems elsewhere in the world, U.S. crop exports are as good as they can be at this time.

Meanwhile, the United States is amidst a rapid soybean crush plant expansion of more than one-fourth of its current capacity. That capacity will require larger volumes of soybeans to remain at home and be crushed in the United States. The push for more crush capacity stems from the need to use soybean oil for renewable diesel efforts that have exploded on the West Coast and now other states and Canada. The volume of soybean meal will be a bright spot as the U.S. will have an abundant surplus available for the global market.

For the barge market, the New Orleans Customs District receives more than 95 percent of the grain and soybeans exported through the district by barge. This district is diverse in the markets it serves, sending most crop exports to more than a dozen countries while the Customs Districts in the Pacific Northwest send most of the crop exports to just a handful of destinations.

Over the horizon, the future is less certain as policy is a key driver impacting crop and coal usage in the United States. Competition elsewhere has been bolstered to challenge U.S. farmers, producers, miners and manufacturers. With the campaigns for president in full swing, there is talk of which candidate will target countries that have unfair trade practices with and against the United States. If 2018 is any guide, it could be a rough ride ahead.

Multinational companies looking to have a beachhead for commodity sourcing and origination can bank on the United States over the long run. The United States is a safe and reliable place to do business. I use a “4-Rs of Supply Chains” for the United States to illustrate the point. One, supply chains are “reliable” as the U.S. maintains a law-and-order approach where legal terms matter. Two, they are “resourceful” with vast commodity reserves and infrastructure. Three, the supply chains are “resilient” with options to serve the world as policy, regulations and politics are more stable in the United States as compared to other regions of the world. Lastly, there is “redundancy” in the system to allow multiple participants to “plug and participate” in commodity markets and manufacturing. Because of the supply chains in the United States, business can be a “both/and,” such as using crops for food and fuel, not an “either/or” option.

Funneling commodities up and down the Mississippi River system has always been cyclical, but now more than ever, global events are felt immediately on the navigable waterways of the United States.

Caption (click on image for full graph): Mississippi River System internal commodity movements.