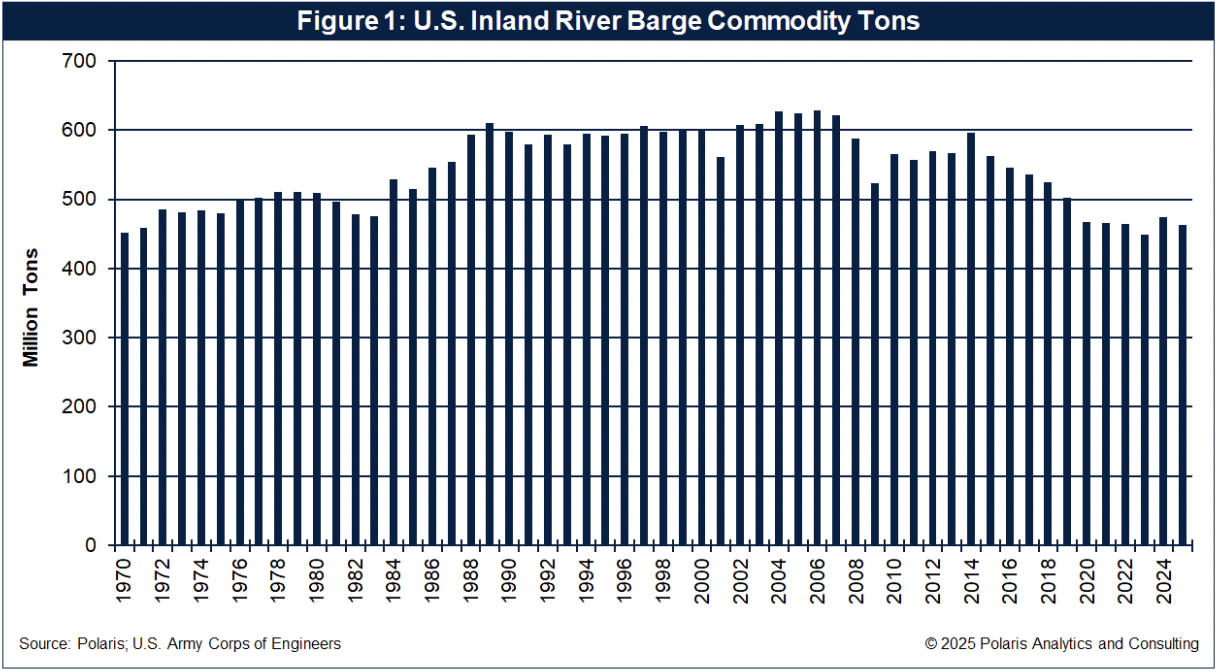

For the ninth consecutive year, commodities moving on the inland waterways were lower than the previous year. Barge volumes for 2023, as reported by the U.S. Army Corps of Engineers in recently published “Facts and Information,” were down 3.3 percent, or about 15 million short tons, to 449 million. Except for coal, petroleum products, sand, gravel and stone, all major categories of commodities had lower volumes during 2023. The Corps released high level details of commodity groupings in its facts and information card and has yet to release more detailed information by specific commodity, barge direction, river segments and ports.

While the Corps is nearly 18 months in arrears with the 2023 data, barge commodity volumes for 2024 are estimated to improve 5.8 percent or by 25.9 million short tons to 474.6 million. The improvements are expected to come from movements of petroleum and petroleum products, chemicals, food and farm products. If realized, barge movements during 2024 will have been the highest volumes moved on the inland waterways since 2019.

Internal barge movements for 2025 are forecast to pull back 2.4 percent, or 11.5 million short tons, to 463.1 million short tons.

Market Drivers Influencing Barge Volumes

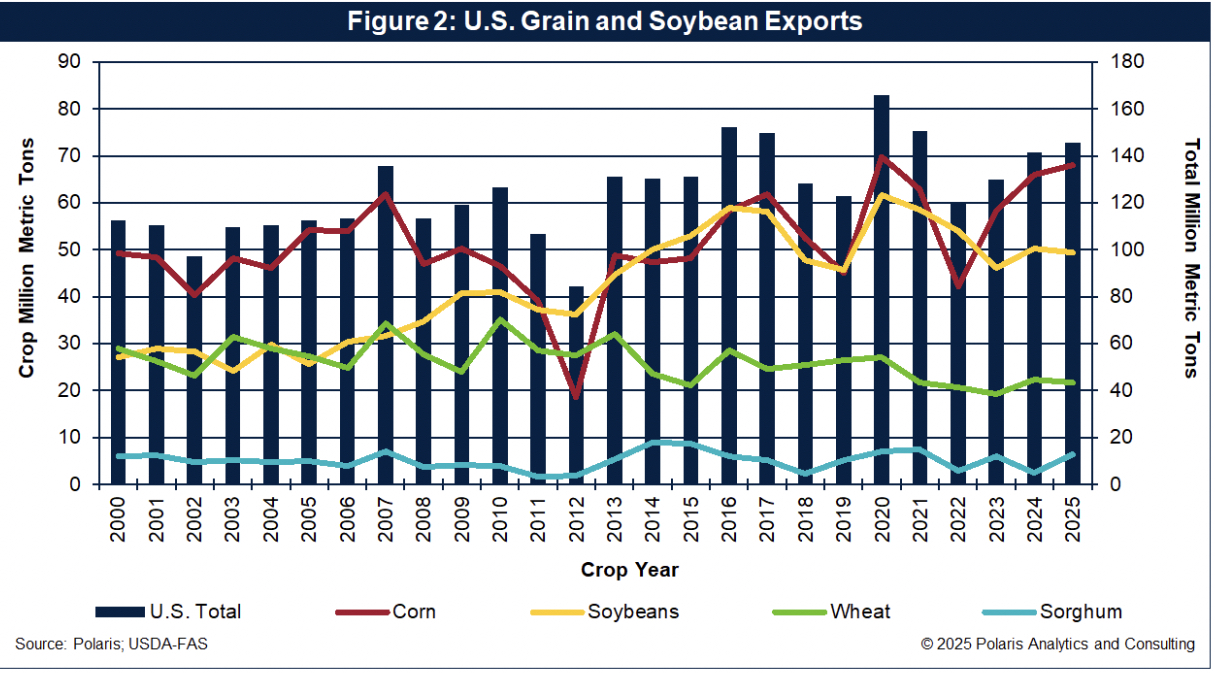

Despite consecutive years of lower volumes, there are firm influences on barge commodity movements through 2025 and for 2026. U.S. grain and soybean exports for the 2024-25 marketing year that ends August 31 are forecast to total 141.5 million metric tons, about 9 percent higher than the previous marketing year. In the U.S. Department of Agriculture’s first look for the 2025-26 crop marketing campaign, exports are forecast to increase another 3 percent to 145.6 million metric tons. If achieved, the new crop exports would be the fifth largest in U.S. history.

Grain and soybean exports are important to the covered barge market. About 60 percent of U.S. grain and soybean exports are shipped through export grain elevators on the Mississippi River Ship Channel. More than 95 percent of the exports through those elevators arrive by barge.

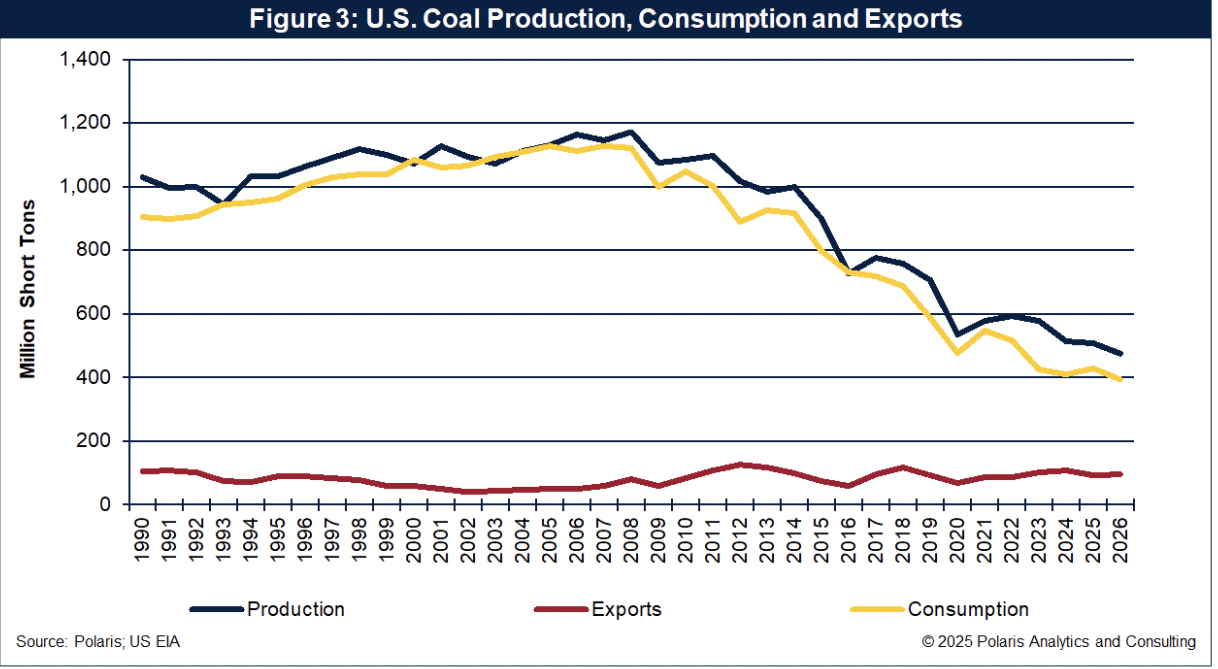

U.S. coal production continues its downward trend, ending 2024 at 512.1 million short tons, a drop of 11 percent or 66 million from 2023. For 2025, production is expected to retreat 1 percent, or by 5.7 million short tons, to 506.4 million tons and fall another 6 percent, or 31.5 million tons, to 474.9 million in 2026. Total U.S. consumption will be mixed over the same period, increasing 4 percent in 2025 to 427.1 million before shedding 7.8 percent to 393.9 million in 2026.

Coal exports may have peaked during 2024 at 107.6 million short tons, the highest level since 2018. For 2025, coal exports are forecast to drop 12.9 percent to 93.7 million short tons before increasing 1 percent during 2026 to 94.6 million. Changing coal dynamics have been the key driver pushing barge movements lower the past decade.

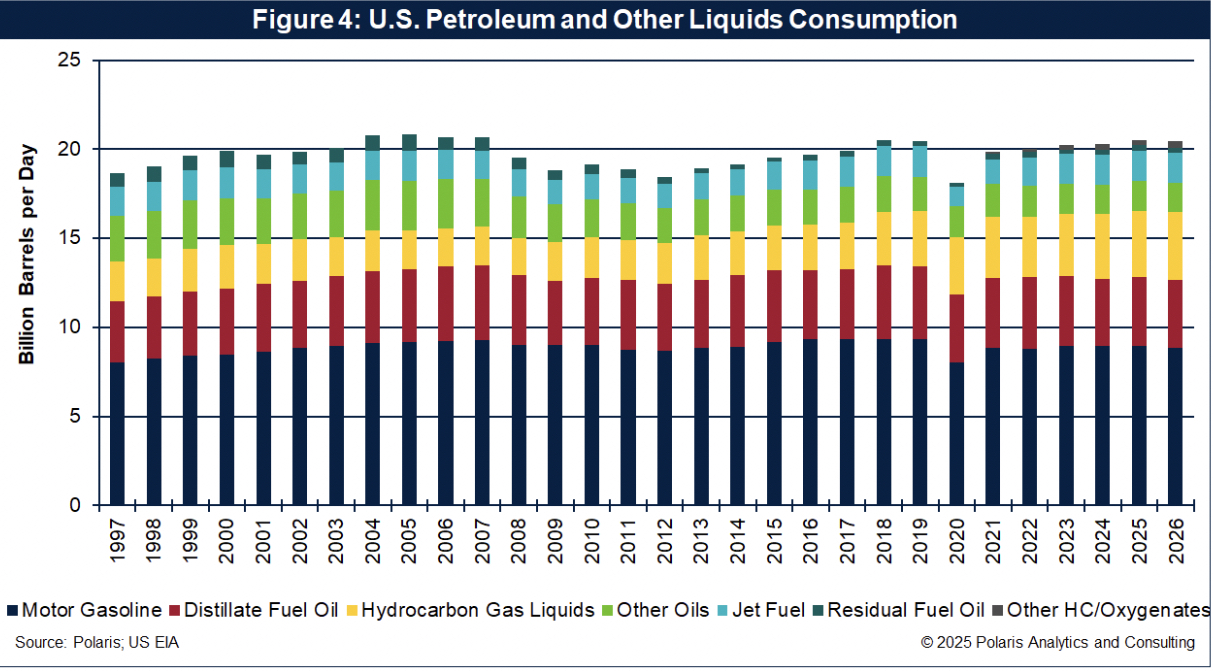

U.S. petroleum and other liquids consumption has nearly returned to pre-COVID-19 levels, totaling 20.3 million barrels per day during 2024. For 2025, consumption is forecast at 20.5 million barrels, about equal to 2019. However, for 2026, consumption is forecast to slow to 20.4 million barrels.

Petroleum and other liquids are a considerable volume of commodities moved by liquid tank barge. With consumption recovering to pre-COVID-19 levels, this provides stability and opportunity for the tank market.

Barge Fleet Replay Of The 3-Rs – Retire, Replace, Resurge

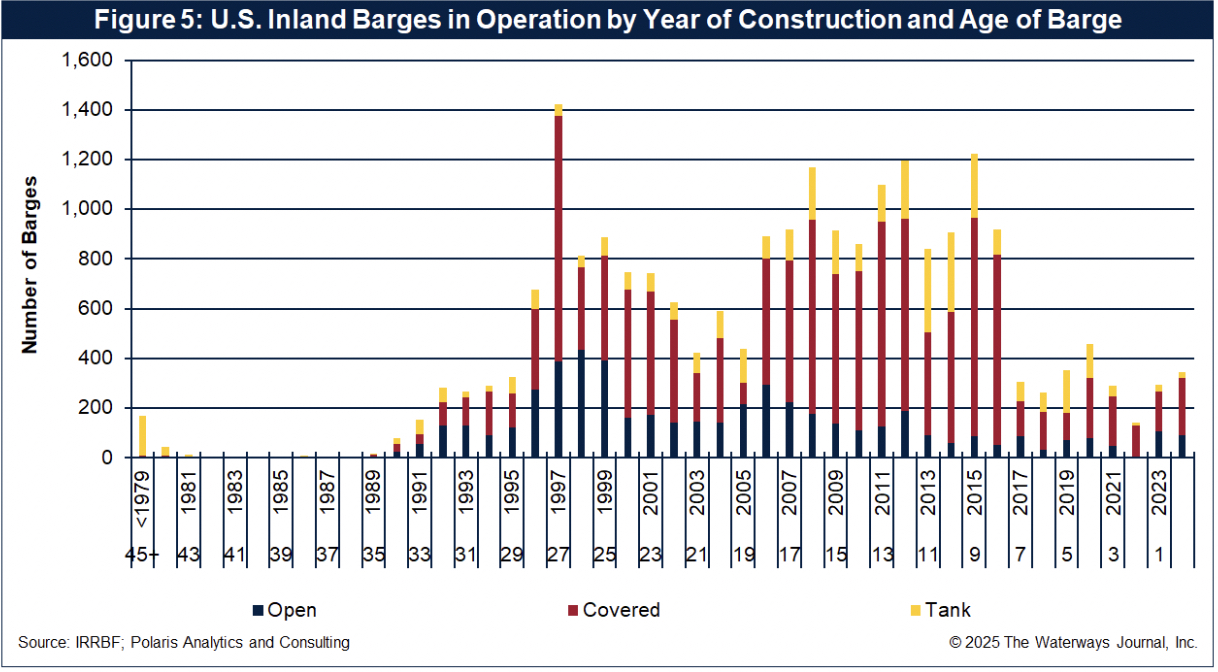

As discussed in last month’s Horizons column, the number of barges at work on the Mississippi River System, its connecting waterways and the Gulf Intracoastal Waterway during 2024 totaled 22,385 barges (dry covered, dry open and tank). The fleet increased 29 barges, or by less than one tenth of one percent. On December 31, the dry covered fleet totaled a record 13,379 barges, an increase of 58 from 2023, while there were 5,083 dry open barges (a decrease of 5) and 3,923 tank barges (a decrease of 24).

As stated in April’s column, the barge fleet needs retirements and replacements, but also a resurgence. Nearly 40 percent of the 2024 fleet, or 8,577 barges, was equal to or older than 20 years. Looking at equipment 25 years and older, there were 5,448 barges in that age range, or 25 percent of the fleet. Regardless of how the fleet is viewed, there are older barges that will soon need to be sliced and diced as retirements.

To support dynamic fleet opportunities, those retirements will need to be replaced. With only one large builder of dry and tank barges, a smaller builder of dry barges and others who build specialty tank barges getting in line to replace retired barges, replacing the fleet could be a challenge.

The picture is a bit more cloudy in terms of growing the fleet, given the near-term outlook of key commodities moved by barge type. However, if “America first” priorities are fully implemented with permanent tax relief, reduced regulations and oversight, improved investment opportunities and expansion of manufacturing, a case could be made for resurging demand for commodity and product movements.

Part of resurging the fleet is improved utilization through data analytics and overcoming challenging workforce trends. Data analytics offer to usher in AI-driven insights for operations to enhance equipment utilization. Importantly, such analytics, when aptly deployed, could improve water management to adjust for low- and high-water events that have plagued the Mississippi River System in the past three years.

Digging Deeper Into The State Of The Industry At IMX

A State of the Industry panel at IMX on Friday, May 30 will deal with domestic and export commodity growth opportunities, fleet dynamics and how AI has a role in resilience. See you in Nashville!