If cargo is king, ports are its cupbearers, barges its royal carriages and towboats the unsung Trojans powering America’s inland waterways.

The fleet of towboats operating on the navigable waterways of the Mississippi River and its connecting waterways are diverse in size, age, ownership and engine make.

Towboats come in all sizes, built for various purposes. Some of the largest vessels in terms of horsepower operate in mainline service, moving large tows of up to 56 barges between Cairo, Ill., at the confluence of the Ohio and Mississippi Rivers to the Mississippi River Ship Channel that starts at Baton Rouge, La., and flows out to the Gulf.

Other towboats push a dedicated number of barges, such as two to six tank barges. Smaller horsepower towboats are used in harbors up and down the entire stretch of the waterway system, positioning barges within fleets and terminals and along smaller rivers and canals.

As of this year, there are more than 3,750 towboats operating in the U.S. commercial and government fleet. The Waterways Journal captures towboat data, making it available through the Inland River Record. That data was used for this Horizons column.

An Aging Towboat Fleet

No one likes to talk about their age, but the inland towboat fleet averages nearly 36 years old. The oldest towboat in operation is the mv. Pammie, built in 1926 by Humboldt Boat Service in Memphis, Tenn. The Pammie is owned by Mike’s Inc., which repowered it in 2015 for use as a yard boat.

Age is not a barrier to service when vessels can be refurbished with new steel, controls and engines, making them nearly new and highly useful. The only thing not to change on a towboat is the original hull date, which stays with the vessel for its life.

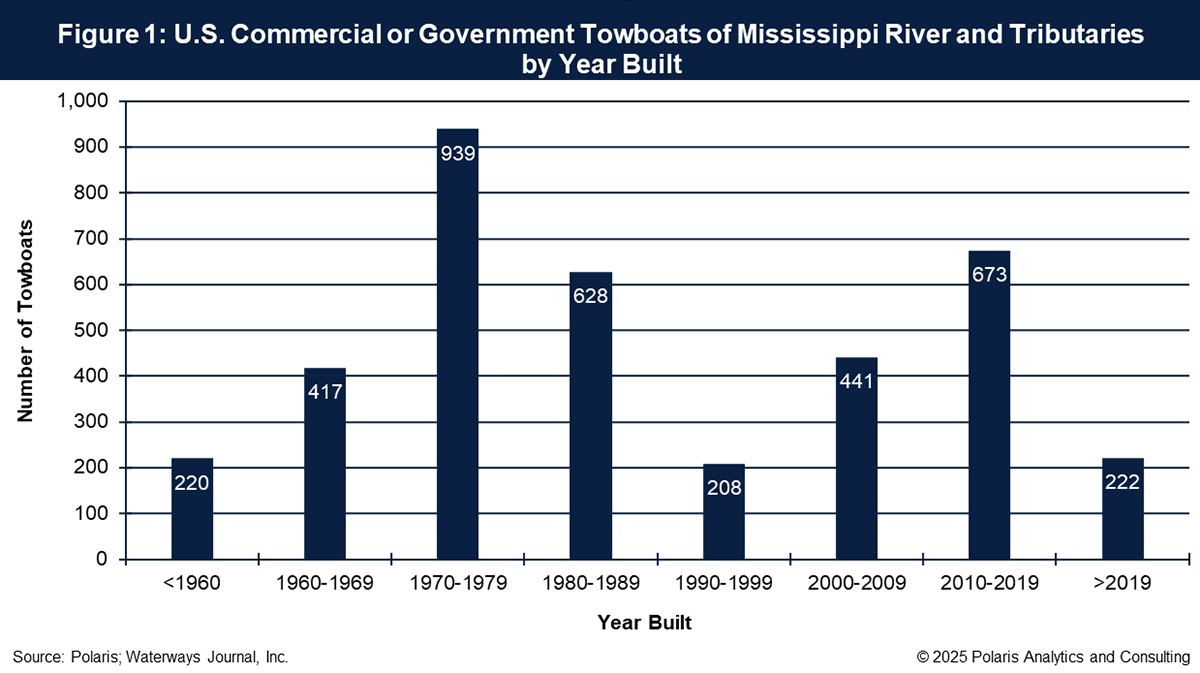

Nearly 60 percent of the towboat fleet is 36 years and older. The highest number of towboats were built from 1970 to 1979 (46 to 55 years old), totaling 939, and the fewest (208) were built between 1990 and 1999 (26 to 35 years old).

Horsepower: Small Boats Do The Heavy Lifting

Towboat horsepower is important, depending on use and operating conditions. The largest horsepower towboats—those with more than 10,000 hp.—are pushing barge tow configurations of up to 56 barges. A 56-barge tow covers nearly nine acres—a fact highlighted in a previous Horizons column (see WJ, August 9, 2024). If those 56 barges are loaded, they could be hauling upwards of 100,000 short tons of cargo, more than enough to fill one and a half Panamax vessels or a small Capesize vessel in the Mississippi River Ship Channel. Moreover, if the cargo was soybeans, that tow would represent nearly 64,600 acres of farmland.

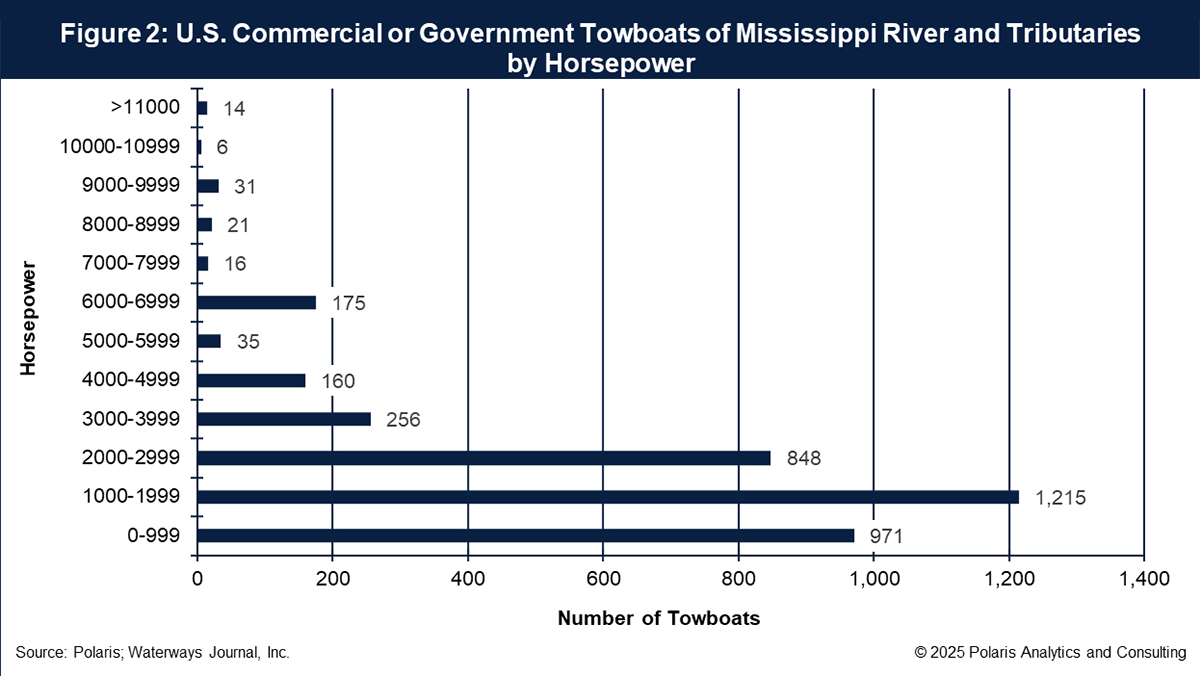

While the large horsepower towboats of 7,000 hp. and greater receive much attention, there are fewer than 100 of those, representing just 2.3 percent of the towboat fleet.

The real workhorses of the fleet are towboats with less than 3,000 hp. This segment of the fleet accounts for 81 percent of the inland towboat fleet, and most of those are between 1,000 and 2,000 hp. Most are dedicated to smaller tows or serving the hundreds of ports, terminals and berths that dot the inland waterway system.

Operators: From One-Boat Firms To Industry Giants

This year, there were nearly 570 companies operating commercial and government towboats. Some of the companies, obviously, operate under the same or similar leadership. Others are financial institutions. Nearly one-half, or 223, companies reported operating one towboat serving construction, harbors and other services. Another 20 percent, or 109, reported having two towboats.

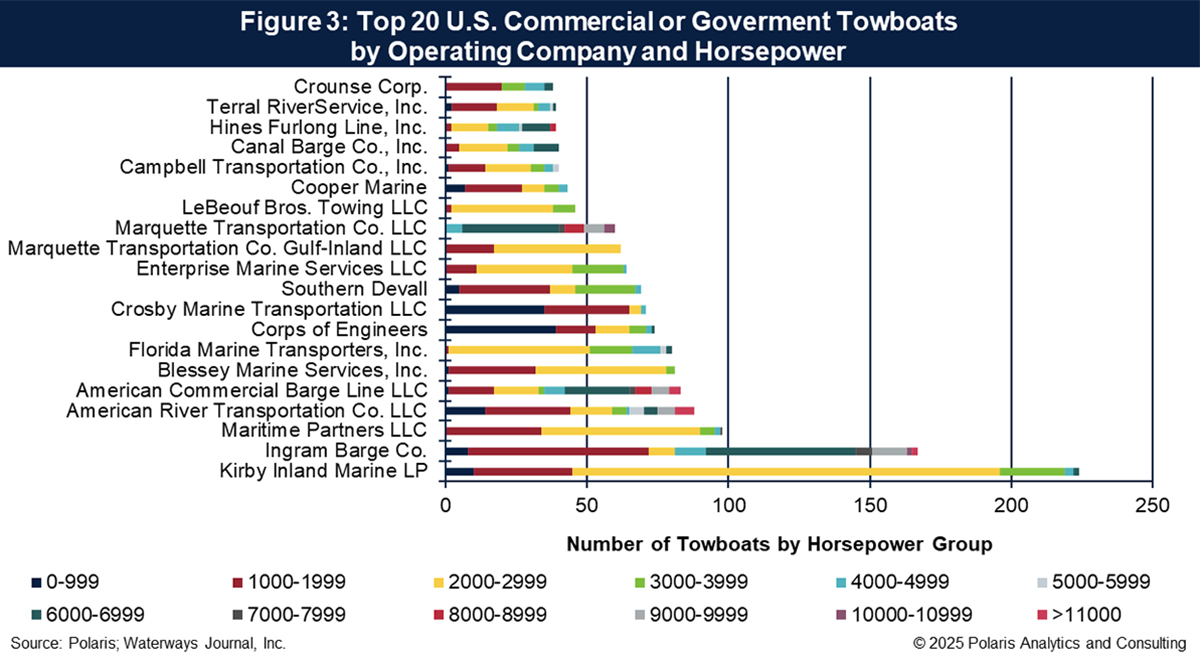

At the other end of the spectrum are the mainline towing companies that have the highest number of towboats. Kirby Inland Marine operates the largest fleet of towboats with 224. Kirby operates as many barges as all the companies reporting one towboat combined. As a liquid tank barge operator, Kirby uses smaller horsepower towboats. The age of the fleet at Kirby averages 16 years old, with two that are 1 year old. The oldest is 51. By and large, Kirby’s mainstay horsepower on its towboats is 2,000 to 2,999 hp., while the largest units are 6,000 hp.

Ingram Barge Company is a diverse operator pushing dry open, dry covered and liquid tank barges. This year, Ingram accounted for 167 towboats. Its towboat fleet age averages 44 years from a low age of 1 year to a high of 61 years. Ingram uses a mix of horsepower, averaging 4,140 hp., with a concentration of 1,000 to 1,999 hp., most likely for liquid tank service, and 6,000 to 6,999 hp. for dedicated tow configurations or river segments. Ingram operates two towboats with 11,000 hp.

Western Rivers Boat Management Inc. operates the largest horsepower towboat, the 13,200 hp. mv. Lewis B. Strait, which was built in 1978.

Builders: A Shrinking Cadre

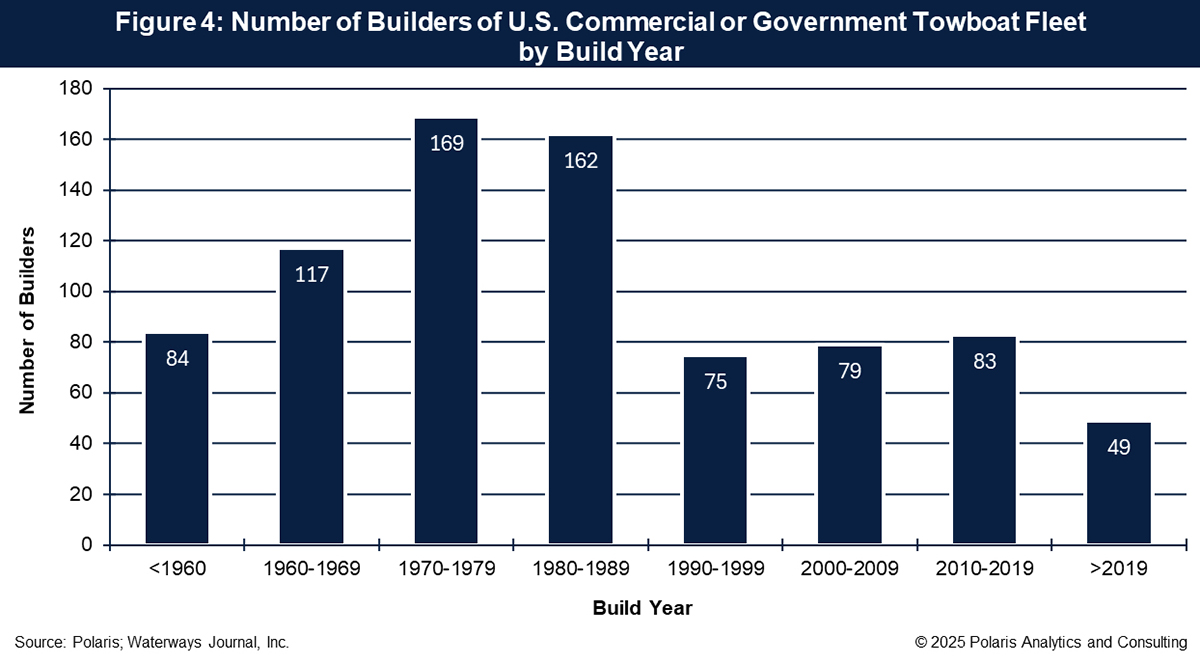

The current towboat fleet was built by 515 different builders. Many of those builders no longer exist or were acquired, merged or exited the towboat building business. The trend of fewer builders of towboats and barges reflects the contraction of the United States’ defense and ship-building capacity.

The highest number of builders of the 2025 fleet totaled 169 companies between 1970 and 1979. St. Louis Ship built the most towboats between 1970 and 1979. It closed operations in 1984, but its name lives on as a prominent builder of towboats still in service today.

The number of shipyards building towboats was slightly less from 1980 to 1989, totaling 162. Since then, the number of builders has dropped by half.

Since 2019, nine builders built nearly 60 percent, or 130, of the 223 towboats that are in service. C&C Marine & Repair delivered 22, followed by Main Iron Works and Steiner Construction, which each built 15.

Towboats: Built To Last, Built For Commerce

This fleet tells a story of endurance and adaptation. Despite consolidation among operators and builders, towboats remain indispensable—quietly powering U.S. trade and global supply chains. Built to last, they keep commerce flowing, feeding and fueling economies worldwide.

While towboats endure and adapt, the dwindling of shipyards—defense and commercial yards—have been thrust into the public eye of late with debate over the SHIPS For America Act and the president’s executive order aimed at reinvigorating U.S. shipbuilding.

How will the contraction of shipyards be reversed and can the U.S. maritime industry ride a wave back into prominence? Those are certainly questions on the horizon.