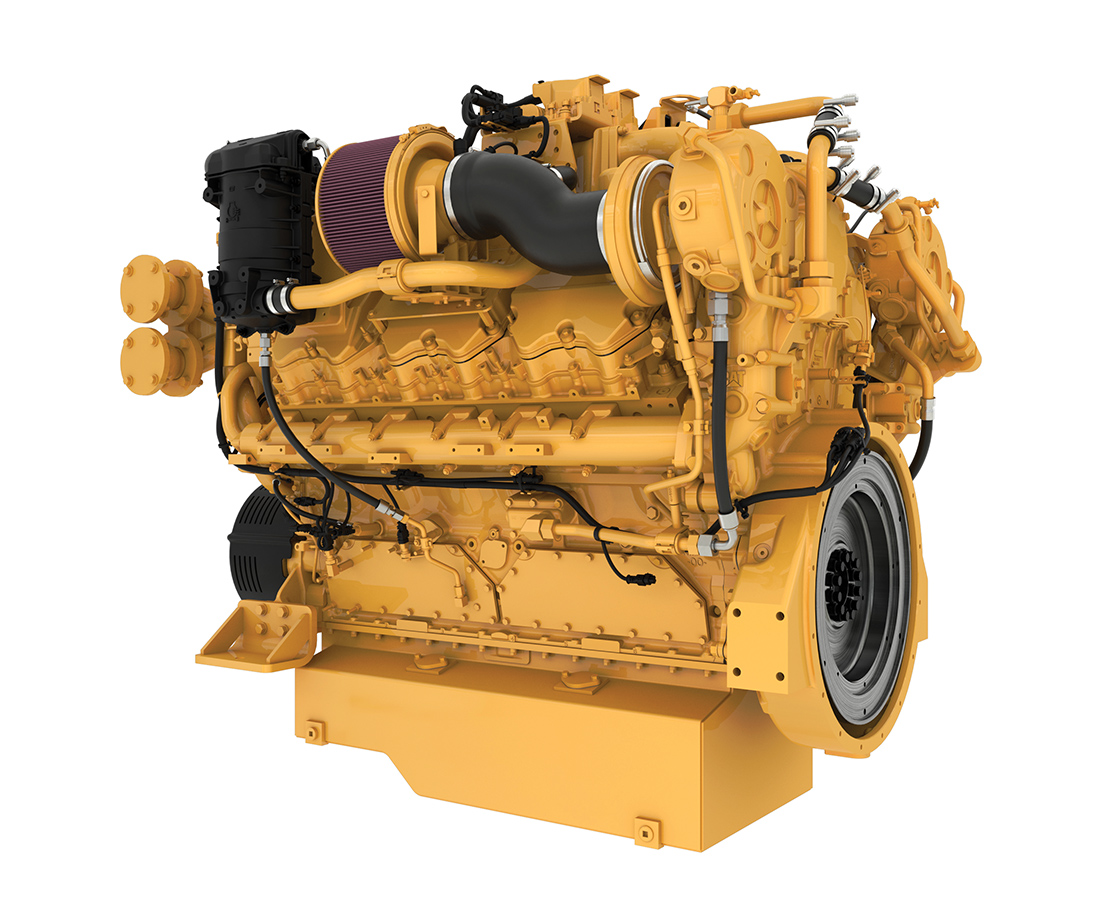

Caterpillar has taken the wrapping paper off its new C32B commercial marine engine, the successor to the popular C32 engine, and the company plans to highlight the new engine at the upcoming WorkBoat Show next month.

The WorkBoat Show will be held December 3–5 in New Orleans.

With the C32B, Caterpillar is offering towboat operators options to fit their needs for both Tier 3 and Tier 4 repowers and new builds. The continuous duty Tier 4 version comes in 1,200 and 1,300 hp. operations for new builds and 1,000 hp. for repowers. The Tier 3 version comes in 800 and 1,000 hp. options.

The debut of the C32B comes at a critical time for shipyards and owner-operators, said Gary Sarrat Jr., tug and inland waterways segment account manager for Caterpillar Marine.

“The EPA allowed for shipyards and operators to lay a keel and get a set of engines that could qualify for Tier 3 units,” Sarrat said. “We’ve seen that almost for the last 10 years. Now that inventory of Tier 3 engines and keels has essentially run out, we’re seeing shipyards and owner-operators make decisions based on do they want to build smaller vessels with smaller horsepower and go Tier 3, jump into Tier 4 and build a new vessel, or repower.”

For a newbuild, it’s more cut and dried. The EPA places an 803 hp. per engine cap on newbuild towboats with Tier 3 engines. Newbuilds above that per-engine threshold have to go with Tier 4 main engines.

Repowers, though, present more options, with a wide array of costs and construction needs.

“Number one is the cost to reconfigure a vessel for SCR systems and DEF tanks,” Sarrat said, referencing diesel exhaust fluid and the selective catalytic reduction system that Caterpillar engines use to lower emissions. “Number two, the cost of new construction is quite high, so operators are evaluating where the best bang for their buck is. Another factor is that our inland waterways vessels operate in mostly fresh water, so those hulls are able to stay together and be viable for 40-plus years. When you get to 20 years on a vessel, and you’re at that halfway point, a repower makes a lot of sense.”

When asked whether Caterpillar Marine favors one pathway over the other, Sarrat said the company stands ready to meet either need.

“It really comes down to a company’s plan for a particular vessel and what type of work it’s going to be doing,” Sarrat said. “We remain agnostic as far as which path you take. We have solutions for customers whether they choose to repower with a set of Tier 3s or want to go up to Tier 4.”

Caterpillar works with gearbox manufacturers, shipyards, designers and naval architects alike to identify ways to adapt an older vessel to accept Tier 4 SCR systems and repurpose tankage for DEF fluid. Sarrat said the tankage problem is usually easily solved.

“Our SCR system doesn’t consume the amount of DEF that people feared initially when this technology was rolled out,” he said, adding that DEF consumption in normal operating conditions is around 2 or 3 percent of fuel burn. “Really, the hard work is to take an existing vessel and find the best way to orient the SCR system in the vessel.”

Typically, he said, companies are able to reclaim space in the stacks in order to fit scrubbers there. In addition, older engines often have a larger footprint than the C32B, so swapping to a new engine frees up space in the engine room.

Beyond the obvious advantage of reducing emissions, swapping to the new C32B engine delivers a 50 percent increase in time before overhaul, improved fuel efficiency, heightened load management and a boost in durability over the original C32. The C32B also adds more modern controls and telematics to allow companies to track engine status and alarms in real-time and plan service intervals strategically.

“All these things are part of the recipe to try and get the best value out of your engine,” Sarrat said.

Beyond the new C32B commercial marine engine, Sarrat said he believes further innovations are on the horizon for engine manufacturers and towboat operators in terms of drop-in and alternative fuels. Renewable diesel—or diesel derived from agriculture products, primarily—remains the most accessible drop-in fuel. Renewable diesel can be mixed with conventional diesel or used in total, and companies could switch from renewable diesel to conventional diesel, depending on area of operation or availability. That sets renewable diesel apart from biodiesel, which can only be used in lower ratios with SCR systems and poses storage challenges due to algae growth and susceptibility to water contamination.

“Renewable diesel really, truly is a mixable, drop-in fuel,” Sarrat said.

Supply for renewable diesel, though, is tight, especially with subsidies driving much of the supply to the West Coast.

Next to renewable diesel, Sarrat thinks methanol is the next lowest hanging fruit. Handling methanol is “pretty simple, somewhere between gasoline and diesel,” Sarrat said, and it stores well. What’s more, it’s a common commodity moved on the inland waterways, meaning crews are used to handling it. The energy density, though, is a quarter of diesel’s, which means a vessel would have to carry 2.4 times the methanol to achieve the same energy output of diesel. Caterpillar has spent years developing methanol-fueled engines, and Sarrat thinks those will eventually make it to the waterways, most likely first in places where methanol is already moved, like the Houston area.

“We may not see it widely adapted right away because of some of the areas where inland waterways vessels are operating, but I think we’ll see it start to creep in, especially with some incentives or subsidies,” he said.

Liquid hydrogen, Sarrat said, seems a poorer fit for the inland waterways, given its energy density and cryogenic storage requirements. Land-based generator sets supplying electricity are a more accessible application for liquid hydrogen, he said.

With the 40th anniversary of the Back To The Future franchise putting those movies back in the headlines, Sarrat admitted that Caterpillar doesn’t have a version of Doc Brown’s Mr. Fusion just yet.

“While we don’t have a Mr. Fusion per se, we have a number of engines running in our test facilities on methanol, ammonia and liquid hydrogen, and we’re taking that development and putting it out in the field where it makes sense,” he said. “As far as marine goes, renewable diesel and methanol are probably the two that we’ll see come to fruition and spread within the next five to 10 years.”

————

Featured photo caption: Caterpillar’s new C32B commercial marine diesel engine. (Photo courtesy of Caterpillar Marine)