Ports are not just docks. They are economic engines. They connect farms to factories, mines to markets and nations to the world. Two recent announcements—one in Argentina, one in Louisiana—illustrate how strategic port investments, paired with smart incentives, drive competitiveness, jobs and trade.

A New Gateway On The Paraná

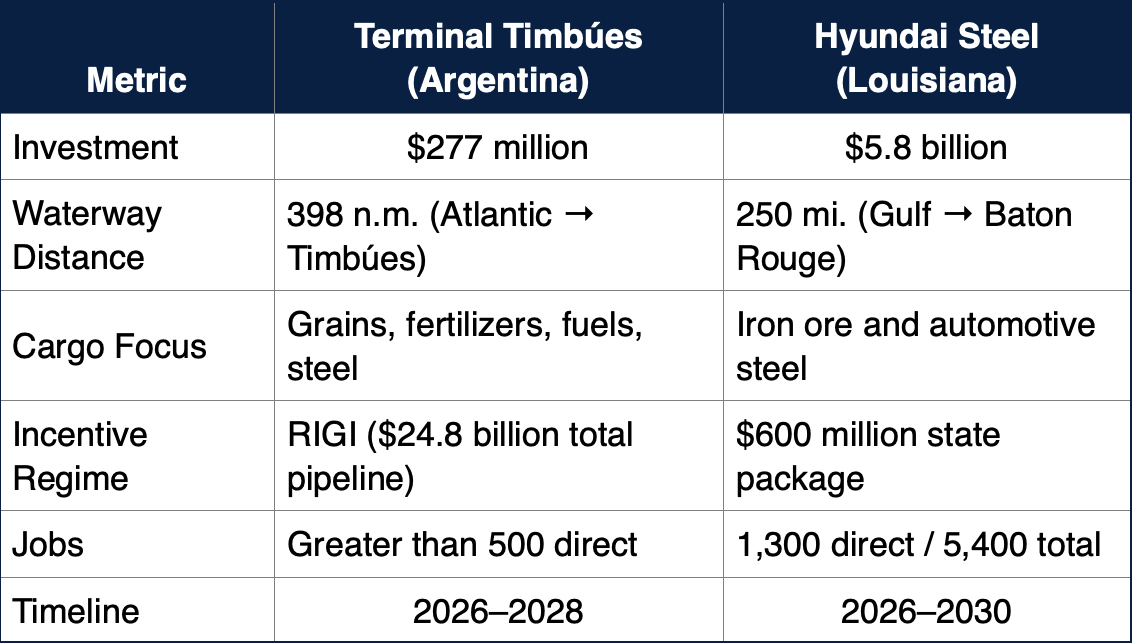

On November 4, Argentina’s economy minister, Luis Caputo, approved a $277 million greenfield port at Timbúes, located in the province of Santa Fe, about 12 river miles upriver from Rosario. The project, which is expected to exceed $290 million, falls under the country’s Large Investment Incentive Regime (RIGI). Developed by Terminales y Servicios S.A., Terminal Timbúes will be a multipurpose hub handling grains, fertilizers, fuels, iron ore, steel and general cargo. The 186-hectare site (equalling 460 acres) will feature close to 3,000 linear feet of river frontage, three specialized piers (agri-bulk, liquids and general cargo), the capability to dock Panamax and Post-Panamax vessels and multimodal connections via rail, truck and barge.

Ocean vessels will transit 398 nautical miles from the Atlantic Ocean via the Paraná-Paraguay Hidrovía, compared to just 250 miles from the Gulf to Baton Rouge, La. The terminal aims to cut logistics costs 10 to 20 percent by easing congestion in the Gran Rosario hub, which is considered the world’s largest soybean export complex, with 15 ports and more than 40 terminals.

Construction will begin next year with a fertilizer import phase. Full operations are targeted for 2028.

RIGI: Argentina’s FDI Magnet

Terminal Timbúes is the ninth RIGI-approved project, pushing total commitments to $24.8 billion. Others include three mining projects (lithium and copper projects totaling $6.6 billion), five energy and infrastructure projects (LNG, pipelines and renewable projects totaling $16.1 billion) and a steel project totaling $286 million.

RIGI offers 30-year tax stability, accelerated depreciation and fast-track permits for investments greater than $200 million ($300 million for non-strategic projects). Another 11 to 15 projects in the pipeline could add more than $20 billion. The program is a magnet for foreign direct investment.

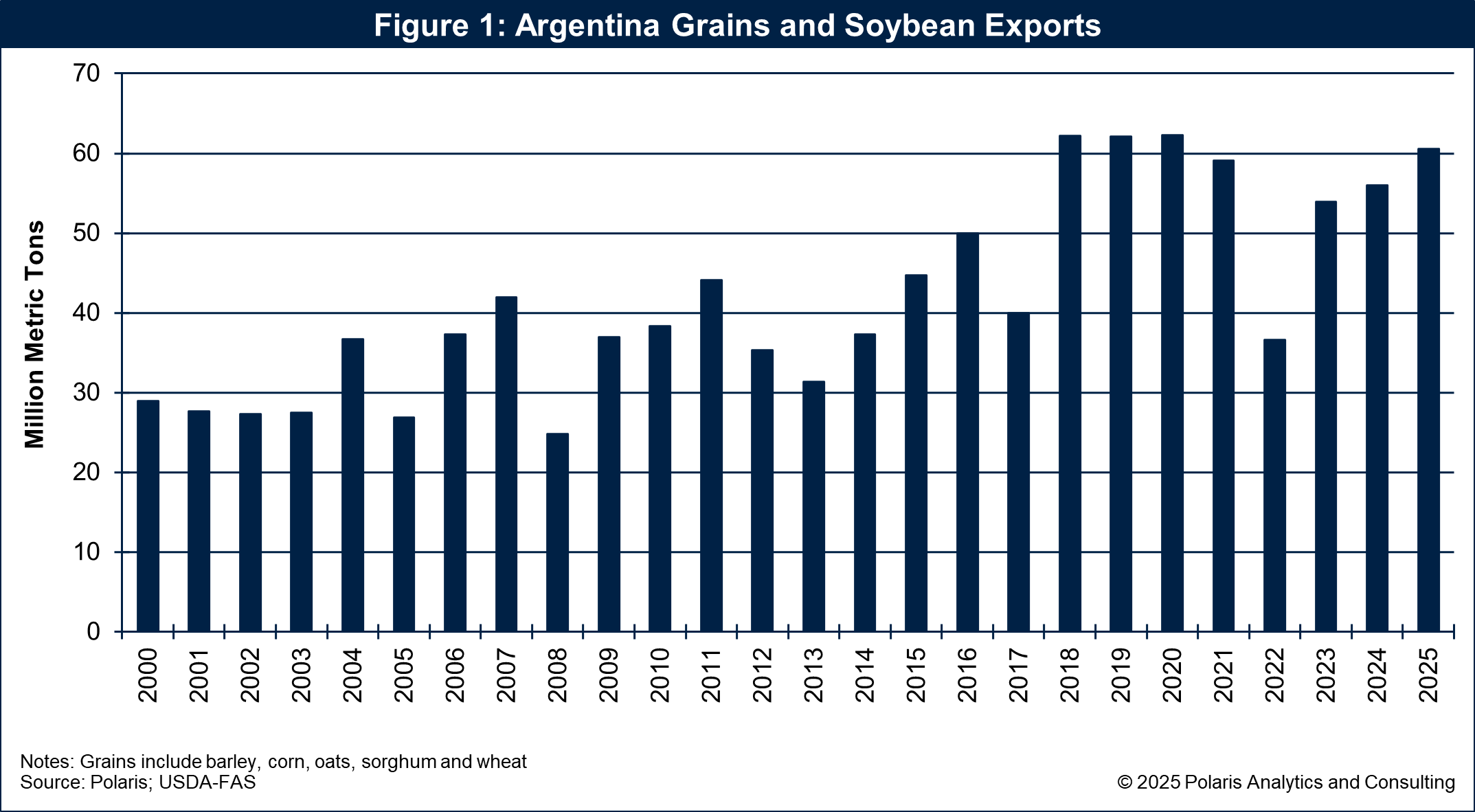

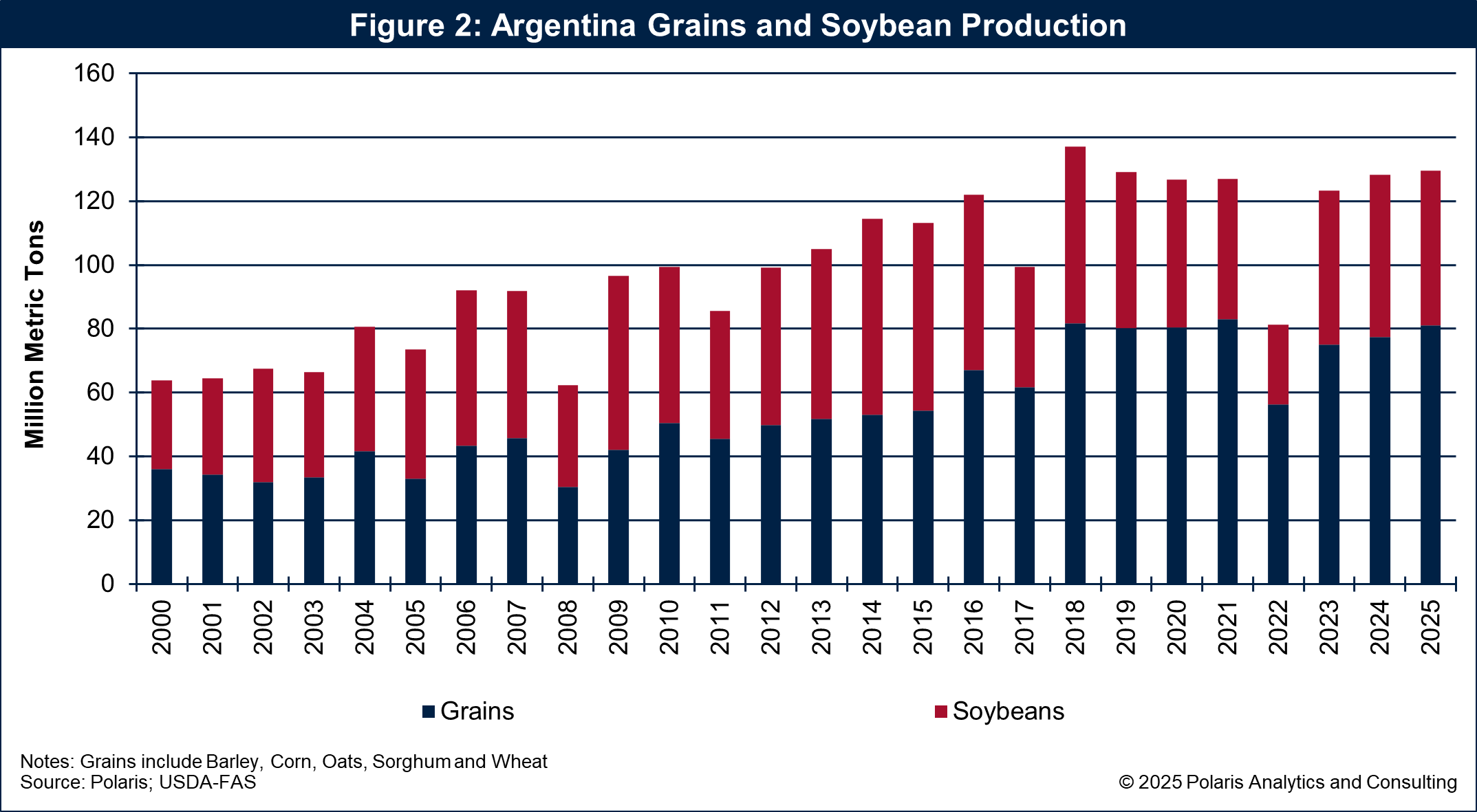

Argentina Soybean Exports

Argentina’s grain and soybean exports have rebounded from the 2022 drought, with 2025 volumes expected to top 60 million metric tons. That’s a 62 percent jump from the low as shown in Figure 1. Production has stabilized near 125 million metric tons, but expansion is constrained by land limits, yield plateaus and climate volatility as shown in Figure 2.

To spur export sales, the government has permanently cut soybean export taxes from 33 to 26 percent as of July 2025 and temporarily suspended taxes from September 22 to October 31 this year. Taxes were reinstated at 26 percent on November 1.

Without new acreage or yield breakthroughs, export growth in Argentina may be nearing its ceiling.

U.S. Counterpoint: Steel On The Mississippi

On the Mississippi River, Hyundai Motor Group is building its first North American steel mill, a $5.8 billion, ultra-low-carbon EAF plant on 1,700 acres in Ascension Parish, Louisiana, within the jurisdiction of the Port of Greater Baton Rouge. The Port of South Louisiana will build and operate a dedicated deep-water dock to handle 3.6 million metric tons of annual iron ore imports.

The mill will produce 2.7 million metric tons of automotive steel coils for Hyundai/Kia plants in Alabama and Georgia, with 70 percent lower emissions than traditional blast furnaces. It will create 1,300 direct jobs ($95,000 average salary) and 5,400 total jobs in the region.

Louisiana’s $600 million incentive package for the project includes a $100 million infrastructure grant, $30 million for a workforce training center and close to $470 million in tax credits and rebates and long-term property tax abatements.

Construction will begin next year, with the facility operational by 2030.

Two Rivers, Similar Playbook

Both the Argentinian and Mississippi River projects hinge on deep-water access, policy incentives and global supply chain needs. Argentina is modernizing to defend its soybean crown, while Louisiana is building a green steel bridge to the auto sector.

The Bigger Picture

Waterways do not just move cargo. They multiply value. A new dock in Timbúes shaves days off grain transit. A steel mill in Baton Rouge turns iron ore into American-made auto parts. Both require dredging, docks and dollars, both public and private.

The infrastructure that makes up the Mississippi River System is aging. Argentina’s Hidrovía faces draft volatility. Still, both nations are betting big: $25 billion in Argentina via RIGI and $23 billion in Louisiana over the last decade.

Ports are not endpoints. They are launchpads for jobs, for exports, for the next decade of global trade.